House prices across Richmond surge ahead of the rest of the country – up by £92,458 in just one year

By Rory Poulter 22nd May 2022

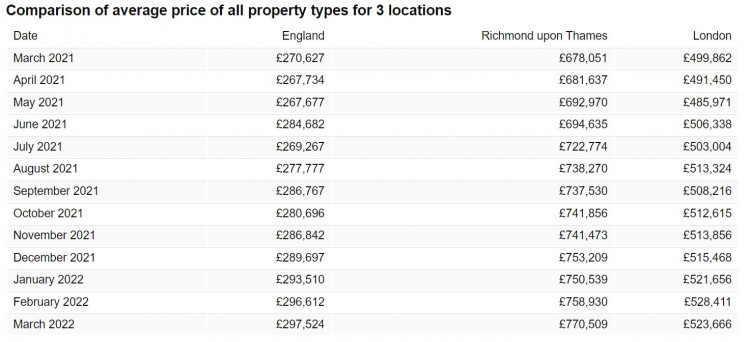

House prices continue to soar across Richmond borough, adding over £90,000 in a year and taking the average sale figure to £770,509.

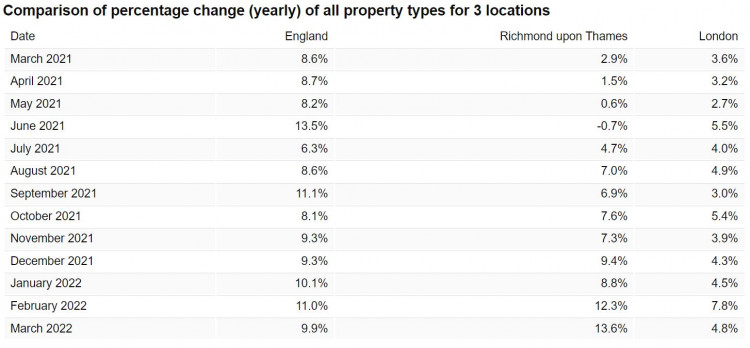

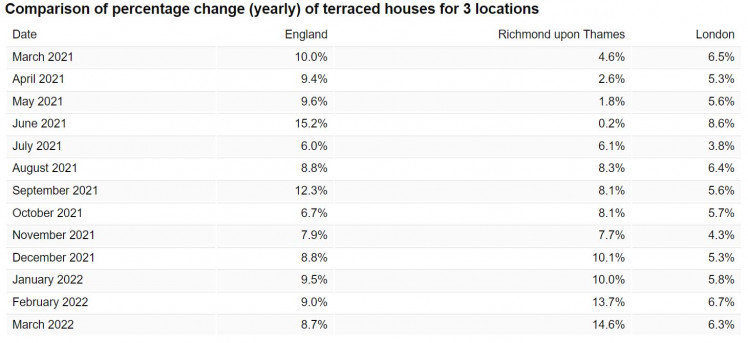

The percentage rise in the 12 months to March 2022 for the entire borough was 13.6%, which is well ahead of the 4.8% for London and 9.9% for England.

The figures come from the Office for National Statistics (ONS) and the Land Registry and relate to the figures that buyers have paid rather the asking prices listed by estate agents.

The booming market appears to be at odds with the fact that mortgage interest rates are rising, making home loan repayments more expensive, and the general increase in the cost of living.

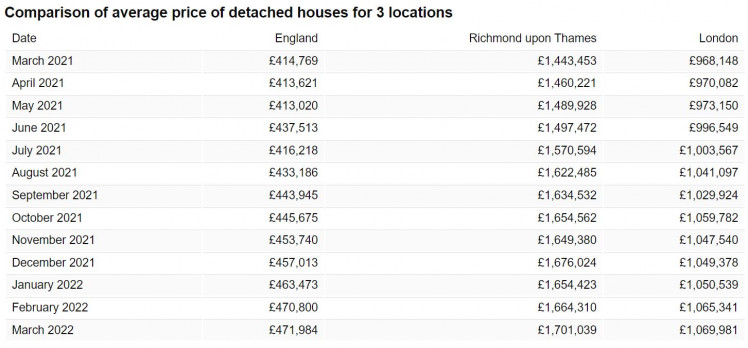

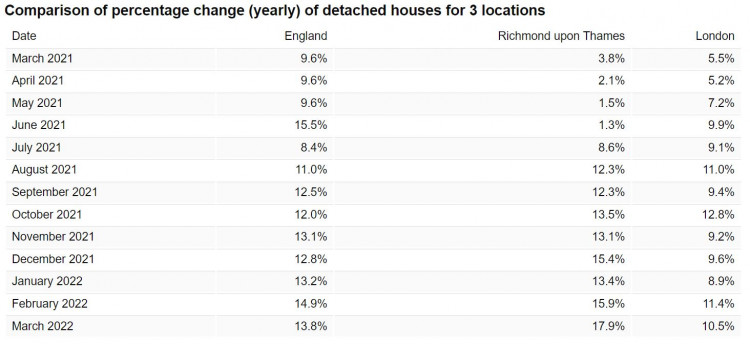

The sale prices of detached properties are soaring well ahead of the rest of the market despite the eye-watering figures involved. Here, the average sale price is up by 13.6% in a year to £1,701,039.

In cash terms, that is a windfall increase of £257,586 over the part 12 months, which equates to staggering rise of almost £5,000 every week.

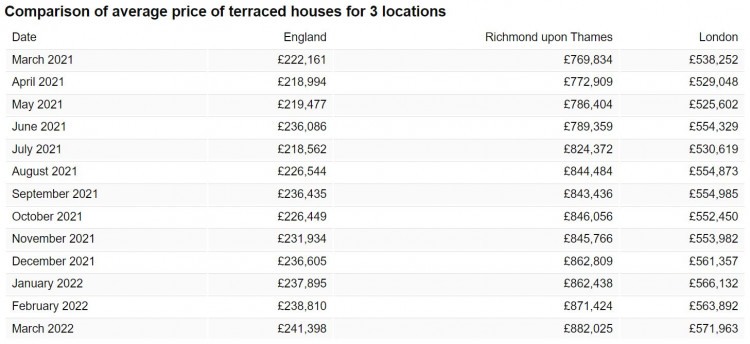

* The average figure for terraced houses is up by 14.6% - £142,161 - to £882,025.

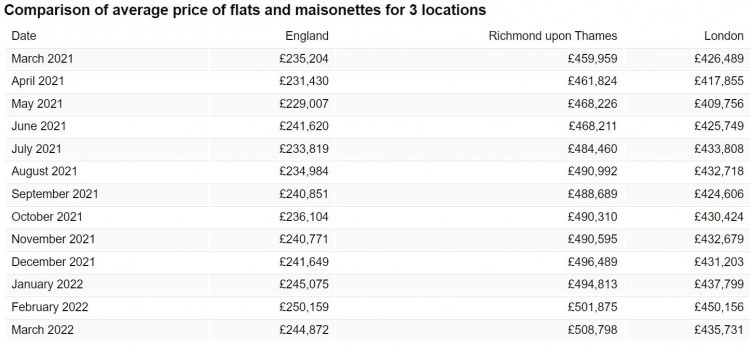

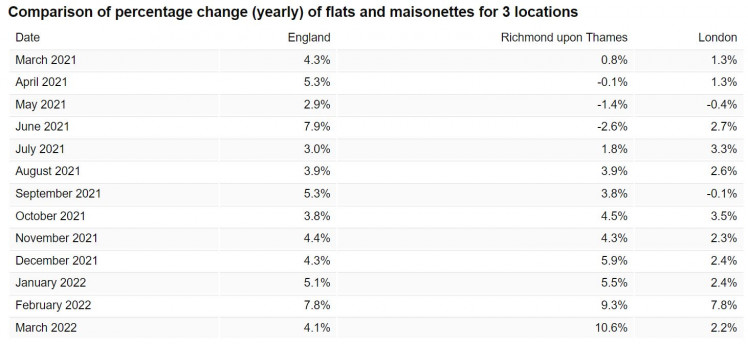

* The average figure for flats and maisonettes is up by 10.6% - £48,839 - £508,798.

Industry experts warn the situation is pricing first time buyers out of the market with a severe shortage of affordable properties.

Richmond Council has drawn up a draft local plan which has a ten year target of delivering 4,110 new homes. Major schemes, such as the redevelopment of Twickenham Riverside and the Stag brewery site in Mortlake, will contribute to this.

Myron Jobson, Senior Personal Finance Analyst at interactive investor, said rising prices and interest rates mean 'consumers are going to struggle to find a property they can comfortably afford'.

He added: "Mortgage affordability is becoming a growing thorn in prospective buyers' side. Mortgage rates have climbed to levels we haven't seen in a while and will continue to do so with further rises in interest rates on the horizon.

"Prospective homebuyers' attempts to stretch their budgets to purchase a property is increasingly being thwarted by the cost-of-living crisis, with inflation surging to 9% in April and expected to reach double digits before the end of the year.

"Many first time buyers will have little option but to give up on their dream of homeownership for the time being. The rising cost of rent makes it harder to save for a first property."

A separate ONS study looking at home rental fees show an annual increase of 0.4% for London, which is below an increase in other areas across England of 3.3%.

It said: "This reflects a decrease in demand, with remote working shifting housing preferences as workers no longer need to be close to offices. It also reflects an increase in supply, such as an excess supply of rental properties as short-term lets change to long-term lets."

ONS house prices statistician Ceri Lewis said: "Our latest figures continue to show house prices increasing and remaining at record levels.

"UK rental prices are also still growing rapidly across all nations and regions. After the falls seen last year, London rental prices continue to pick up with their strongest growth since November 2020."

CHECK OUT OUR Jobs Section HERE!

richmond vacancies updated hourly!

Click here to see more: richmond jobs

Share: